- The U.S. energy industry commits $100 billion to develop American-made battery energy storage systems (BESS) over the next five years, aiming to enhance domestic sustainable energy storage capacity.

- The American Clean Power Association (ACP) and utility companies target 100% U.S. production of energy projects, facing challenges like permitting and trade policy issues.

- Advancements in battery technology lead to lower costs and improved efficiency, with companies like Tesla and Hyundai pushing innovation.

- Form Energy pioneers domestic sourcing, despite relying on some Chinese components due to tariff challenges.

- Post-COVID global disruptions fuel a domestic energy resurgence, spurring American manufacturing efforts by companies like Fluence and LG Energy Solution Vertech.

- Industry leaders like Wärtsilä diversify supply chains, leveraging incentives to create competitive advantages.

- This transformative shift aims to fortify the U.S. electric grid and leads toward energy sovereignty and a clean energy revolution.

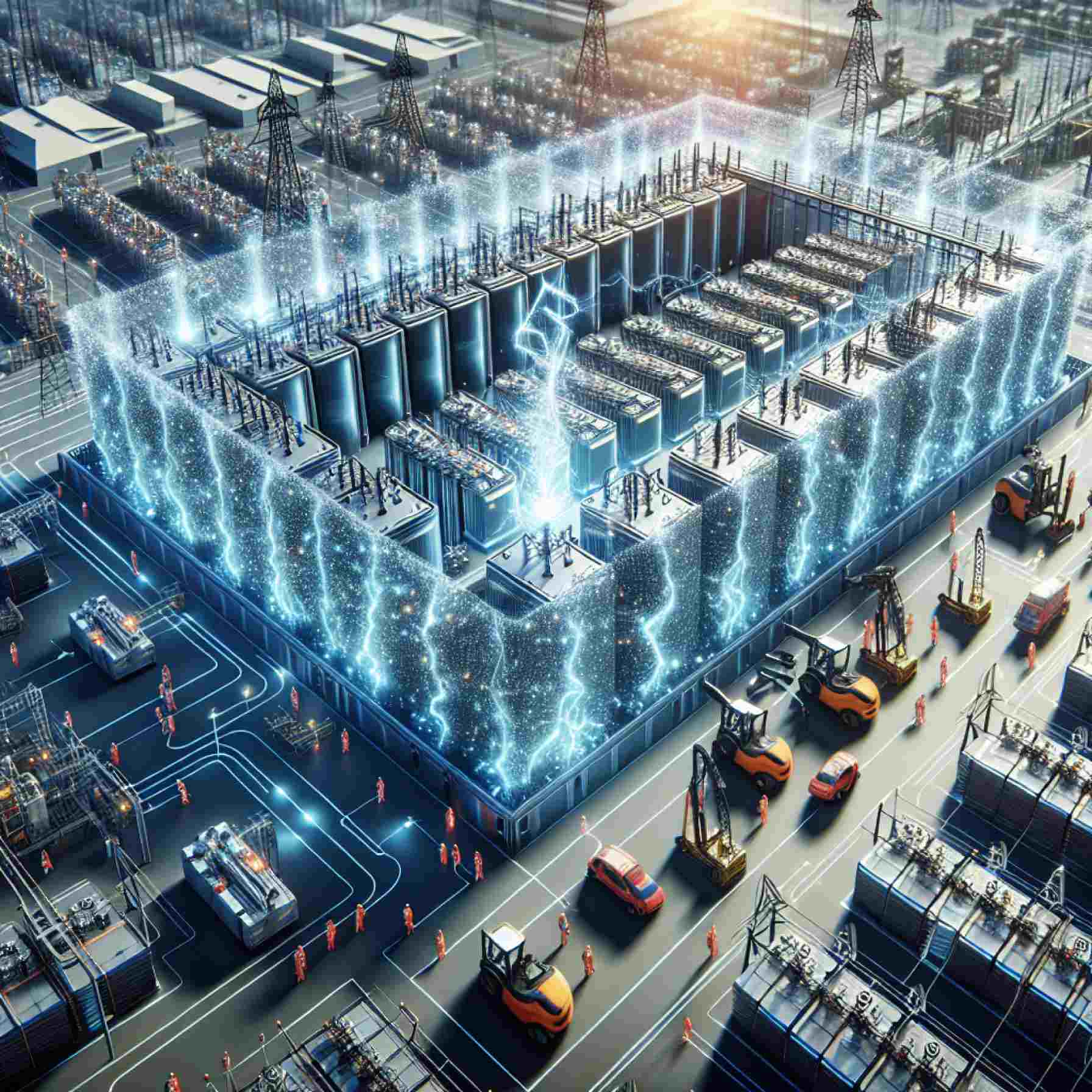

An electrifying new wave sweeps across the American landscape, as the U.S. energy industry unveils a monumental commitment: a $100 billion investment to drive the production of American-made battery energy storage systems (BESS). Within the next five years, this ambitious plunge into the heart of domestic manufacturing aims to supercharge the country’s capabilities in sustainable energy storage.

Dazzling Ambitions, Real Challenges

The American Clean Power Association (ACP), alongside key utility companies, has set its sights on a horizon where 100% of these energy projects are forged on U.S. soil. Yet, the road to this shining future traverses complex terrains—demanding streamlined permits and predictable trade policies. The tension between potential and policy injects both vigor and volatility into this economic and environmental leap.

As battery technology races forward, costs plummet while efficiency and reliability soar. Giants like Tesla and Hyundai are crafting batteries that promise hundreds of thousands of miles of use, heralding a new era of energy freedom. However, the shadow of Asia’s dominance in battery production looms large, challenging the localization vision.

Form Energy stands as a pioneer, boldly sourcing over 80% of its battery content domestically, striving to mine iron in Michigan and Minnesota. But the specter of tariffs on Chinese components still haunts these ventures.

Transforming Turmoil into Triumph

The global disruptions from the COVID era have seeded a domestic energy renaissance. Companies like Fluence have recognized the imperative of cultivating a robust U.S. manufacturing base. Their diligence is now blossoming; domestically crafted lithium-iron-phosphate batteries are poised for deployment. Similarly, LG Energy Solution Vertech accelerates its American production, unveiling plans to unveil 16.5 GWh of storage batteries this year alone.

Moreover, the industry heavyweight Wärtsilä diversifies its supply chain, circumventing market tariffs with components sourced from North America, Asia, and Europe, leveraging local incentives for competitive advantage.

All these initiatives collectively expand the ACP’s already formidable portfolio of active investments, augmenting it by $85 billion.

The Road Ahead

As the world watches, the U.S. projects a confident vision of its future in energy—a harmonization of ingenuity, resilience, and autonomy. This ambitious stride towards true sustainability promises to not only fortify the electric grid but also chart a path towards energy sovereignty.

The key takeaway? America’s energy stakeholders aren’t just investing in batteries; they’re investing in a transformative shift that positions the nation at the cusp of a clean energy revolution. The blend of innovation, policy navigation, and strategic partnerships will undoubtedly redefine the landscape, boosting not just the economy but our collective environmental footprint.

The $100 Billion Battery Boom: America’s Path to Energy Independence

Navigating the Battery Energy Storage Surge

The U.S. energy industry is embarking on a significant $100 billion venture, aiming to enhance homegrown battery energy storage systems (BESS) within the next five years. This monumental investment is poised to transform the landscape of sustainable energy, placing America at the forefront of domestic manufacturing capacity.

Key Challenges in Battery Manufacturing

Despite the ambitious aims, several hurdles stand in the way of achieving 100% U.S.-based energy projects:

1. Regulatory Hurdles: Streamlined permits are essential for smooth progression. However, current regulatory frameworks may slow down project implementations.

2. Trade Policies: Consistency and predictability in trade policies are crucial. The lingering threat of tariffs on Chinese components remains a significant risk to the initiative.

3. Asian Market Dominance: Countries like China and South Korea maintain a strong hold on the global battery market, making it challenging for U.S. companies to compete without significant technological advancements and cost reductions.

Innovations and Industry Players

Key players, like Tesla and Hyundai, are leading the charge with advanced battery technologies promising enhanced efficiency and longevity. Form Energy exemplifies the commitment to domestic sourcing, aiming to obtain over 80% of its materials from within the U.S., while also exploring local mining opportunities in Michigan and Minnesota.

To mitigate tariff impacts, industry leaders like Wärtsilä are diversifying their supply chains, sourcing components globally but leveraging local production incentives.

How-To: Steps for Scaling Battery Production

1. Enhance Domestic Supply Chains: Companies need to develop robust supply chains that can sustain high production volumes without relying on limited or restricted foreign imports.

2. Invest in Innovation: Investing in R&D for new battery technologies can reduce costs and improve performance, making domestic products more competitive.

3. Secure Sustainable Practices: Ensuring sustainable mining practices domestically can support the long-term viability of the industry.

4. Foster Public-Private Partnerships: Collaborations between government and private sectors can drive innovation and streamline regulatory processes.

Market Forecasts & Industry Trends

The global battery energy storage market is predicted to grow exponentially, according to research by Bloomberg New Energy Finance, with expectations of reaching around 2,857 GWh by 2030. This growth is fueled by rising renewable energy installations and the expanding electric vehicle market.

Real-World Use Cases

– Grid Stability: BESS can help stabilize grid fluctuations, integrating renewable sources while maintaining consistent power supply.

– Energy Resilience: In times of natural disasters, localized BESS can provide backup power, crucial for emergency services and critical infrastructure.

– Electric Vehicle Charging: With increased demand for EVs, BESS can support charging infrastructure needs without overburdening the existing grid.

Pros & Cons Overview

Pros:

– Encourages domestic job creation.

– Reduces dependency on foreign energy sources.

– Potentially lowers energy costs in the long term.

Cons:

– High initial investment costs.

– Regulatory and trade uncertainties can hinder progress.

– Existing dominance by Asian manufacturers poses competitive challenges.

Insights & Predictions

The investments made today could position the U.S. as a global leader in clean energy technologies, driving economic growth while supporting environmental goals. Experts suggest that overcoming regulatory and trade barriers will be key to ensuring the success of this initiative.

Actionable Recommendations

For stakeholders looking to capitalize on this trend, consider investing in partnerships with cutting-edge battery technology companies, and stay informed about upcoming regulatory changes that might affect market dynamics.

For more insights on renewable energy and policy developments, visit the American Clean Power Association.

—

With strategic focus and collaborative efforts, America’s battery boom could redefine the energy landscape, ensuring a cleaner, more sustainable future.